I. Synthèse : quels articles ont été modifiés ?

Les articles impactés par ce nouvel arrêté sont les suivants :

- article 1er – la définition d’une entité fonctionnelle assujettie

- articles 3 & 5 – la consommation énergétique de référence

- article 7 – le contenu du dossier technique

- article 8 – les compétences requises pour la réalisation du dossier technique

- article 11 – la modulation des objectifs

- article 14 – la mutualisation des résultats

- article 16 – le changement de sources d’énergie

II. La définition de l’Entité Fonctionnelle Assujettie

Le premier article donne dorénavant une définition précise de l’EFA ou entité fonctionnelle assujettie :

Une entité fonctionnelle correspond à un établissement au sens de la définition de l’INSEE, à savoir : une unité de production ou d’activité géographiquement individualisée, exploitée par une entité juridique.

La notion d’ « unité géographiquement individualisée » se rattache à une localisation géographique précise dans laquelle les activités sont hébergées. Une entité fonctionnelle peut être constituée soit par un local d’activité, soit par un ensemble de locaux d’activités connexes, contenu dans un bâtiment, une partie de bâtiment ou un ensemble de bâtiments situés sur une même unité foncière ou sur un même site.

III. La consommation énergétique de référence

La modification de la surface de consommation

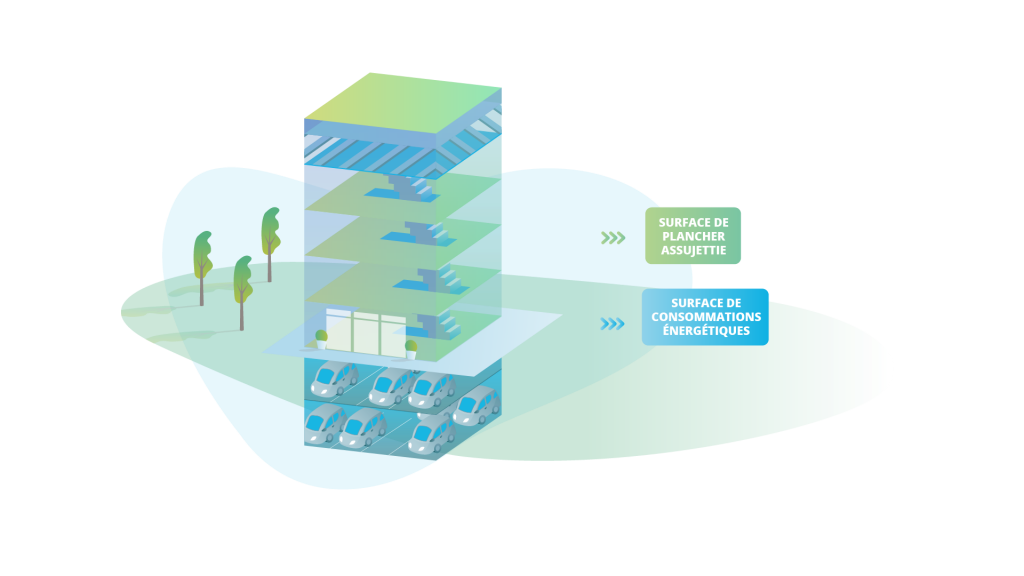

L’article 3 a été modifié afin de simplifier la notion de surface de consommations énergétiques.

La surface de consommations énergétiques correspond à la surface sur laquelle l’ensemble des consommations énergétiques sont prises en compte dans le cadre du décret tertiaire. Désormais, elle peut inclure des surfaces qui ne sont pas assujetties.

On vous explique : prenons le cas d’un immeuble dont la surface tertiaire est de 900m2. Sous cet immeuble, il y a un parking de 400m2. L’immeuble ne sera pas assujetti.

Cependant, si la surface tertiaire de cet immeuble est de 1200m2, celui-ci est assujetti et l’on déclarera sur OPERAT les consommations de l’ensemble des surfaces, soit 1600m2.

Cette modification permet dans certains cas de :

- diminuer le sous-comptage

- simplifier la déclaration

- diminuer la consommation surfacique

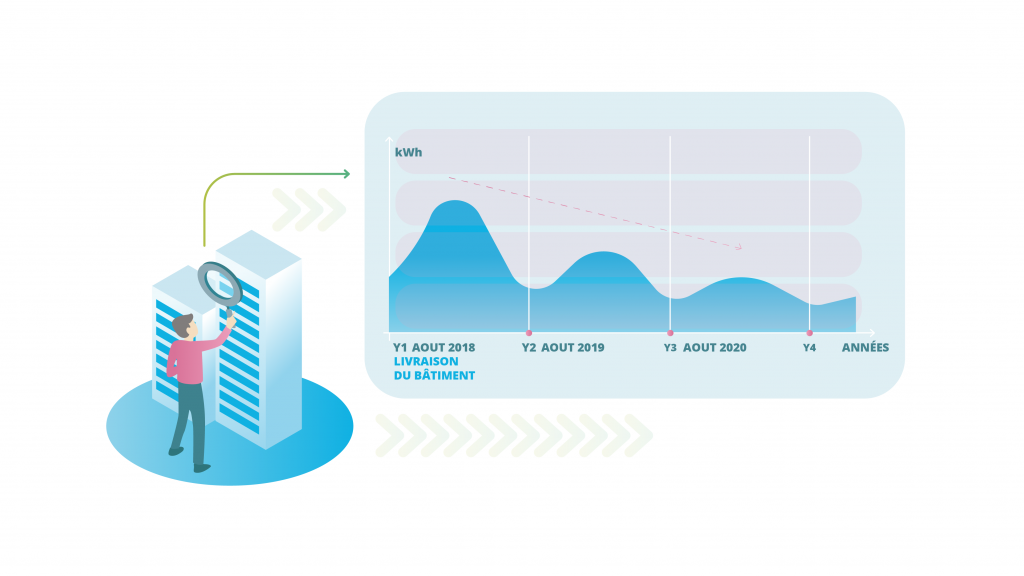

Correction de la consommation énergétique de référence pour les bâtiments neufs

L’arrêté vient préciser, pour les bâtiments neufs, qu’il est dorénavant possible de corriger la consommation énergétique de référence basée sur la première année pleine d’exploitation.

Cela permet de déduire les éventuelles surconsommations énergétiques liées à la surcharge hygrométrique du bâtiment neuf. De plus, cela permet de prendre en considération l’optimisation du bâtiment après réglage optimal des systèmes techniques.

Cette correction devra être effectuée dans les 3 ans suivant la date de réception du bâtiment.

La définition de la consommation énergétique de l’année de référence de combustibles stockables.

Il est désormais établi que la consommation énergétique de l’année de référence de combustibles stockables peut être déterminée à l’aide :

- de données issues de comptage

- d’une estimation des volumes de livraison basée sur des relevés de niveaux

- d’une estimation par lissage des volumes de livraison sur une période regroupant les dernières années de consommations énergétiques dans laquelle l’année de référence est intégrée, sans dépasser 4 années de consommations.

Le calcul de la consommation énergétique de référence

Les formules de calcul de la consommation de référence ont été modifiées : désormais, il faut connaître la consommation en valeur absolue à atteindre pour calculer l’ajustement en fonction des variations climatiques de la part des consommations d’énergie liées au chauffage et au refroidissement.

Enfin, pour les consommations liées au refroidissement, il faut désormais distinguer 4 situations :

- Les locaux d’activité toutes catégories confondues, à l’exception des activités de logistique de froid, de froid commercial et de conservation de documents ou collections

- Les locaux d’activités de froid commercial

- Les locaux d’activités de logistique de froid

- Les locaux d’activités de conservation de documents ou de collections avec contraintes hygrométriques

IV. La mutualisation des résultats à l’échelle de tout ou partie d’un patrimoine

S’il était déjà possible de mutualiser les résultats à l’échelle de tout ou partie d’un patrimoine dans la version du 3 mai 2020, cet arrêté apporte des précisions à l’article 14.

- Le périmètre de mutualisation est défini dans le cadre d’un groupe de structures

- Une validation du représentant légal de chaque entité fonctionnelle qui vaut acceptation du principe de solidarité et d’intégration dans le groupe de structures est nécessaire

- Une entité fonctionnelle ne peut être présente que dans un unique groupe de structures.

V. Les précisions mineures

Cet arrêté vient également préciser quelques points :

- Par exemple, concernant le dossier technique de modulation, l’article 7 nous apprend que l’objectif modulé exprimé en valeur absolue ne peut être supérieur ou égal à la consommation énergétique de référence.

- Dans le même esprit, l’article 8 nous apprend qu’il est possible d’avoir recours à plusieurs prestataires pour réaliser un dossier technique de modulation complet.

VI. Les nouvelles valeurs absolues

Cet arrêté était très attendu pour la définition des nouvelles valeurs absolues. Cependant, il faudra encore attendre : en effet, si cet arrêté liste de nombreuses catégories et sous-catégories supplémentaires, il définit très peu de nouvelles valeurs. Les seules valeurs nouvelles viennent compléter les catégories bureaux – services publics et logistique, parues dans l’arrêté Valeur Absolue I.

Il manque donc à ce jour de nombreuses valeurs : restauration, commerces et galeries commerçantes, santé-hopitaux, blanchisseries, jardineries, etc.

On vous donne rendez-vous cet été pour le décryptage de l’arrêté valeur absolue III !

Inscrivez-vous à la newsletter !